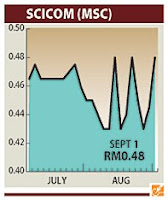

STANDARD & Poors (S&P) maintained its "Hold" recommendation on Scicom (MSC) Bhd (0099), a business process outsourcing (BPO) software provider, but with a raised 12-month target price of 50 sen, from 48 sen previously.

The increase is on the back of the earnings upgrades and on rolling forward valuations.

"Our target price is derived from Scicom's pegging financial year earning per share to a target price earnings ratio of 11.5 times, which is based on a 30 per cent discount to the broader market valuation," it said.

The research house said it continues to like the company for the relative "stickiness" of its business relationships.

Although there is some over-reliance on its major customers presently, the fact that the group has made headway in terms of securing new clients is positive.

This should contribute to a more diversified base over the long term.

S&P said Scicom's fourth quarter 2010 ended June 30 was within its expectations. "Overall pre-tax profit for financial year 2010 declined 21 per cent year-on-year on the back of a 15 per cent decline in revenue."

The primary contributor to this fall in revenue has been the group's US operations.

The increase is on the back of the earnings upgrades and on rolling forward valuations.

"Our target price is derived from Scicom's pegging financial year earning per share to a target price earnings ratio of 11.5 times, which is based on a 30 per cent discount to the broader market valuation," it said.

The research house said it continues to like the company for the relative "stickiness" of its business relationships.

Although there is some over-reliance on its major customers presently, the fact that the group has made headway in terms of securing new clients is positive.

This should contribute to a more diversified base over the long term.

S&P said Scicom's fourth quarter 2010 ended June 30 was within its expectations. "Overall pre-tax profit for financial year 2010 declined 21 per cent year-on-year on the back of a 15 per cent decline in revenue."

The primary contributor to this fall in revenue has been the group's US operations.

No comments:

Post a Comment