Last week saw the blue-chip benchmark FTSE Bursa Malaysia Kuala Lumpur Composite Index (FBM KLCI) in hibernation mode due to limited participation with most investors away for the Chinese New Year holiday. Nonetheless, trading interest in lower liners picked up significantly as retailers came back in full force, especially after external sentiment improved with the US Federal Reserve's pledge to keep interest rates low until late 2014.

The FBM KLCI eased 1.76 points, or 0.12 per cent last week to 1,520.9, with gains in Genting Bhd (+18 sen), Public Bank (+14 sen), Hong Leong Bank (+60 sen), IOI Corp (+8 sen) and KLK (+42 sen) offsetting losses in CIMB (-26 sen), Axiata (-7 sen) and Maybank (-7 sen). Average daily traded volume and value improved to 1.86 billion shares worth RM1.69 billion respectively, compared with 1.59 billion shares and RM1.57 billion in the previous week, as trading momentum increased due to strong interest in lower liners and their call warrants.

While anticipation is building up for a resumption in market uptrend after the Chinese New Year holiday break, the FBM KLCI may continue its consolidation process pending the outcome of the European debt saga, especially in relation to Greece, and risk averseness among investors due to public holidays this week and next. European leaders are expected to meet in Brussels today to discuss further the fiscal framework and method to deal with member nations that can't meet the terms under the bailout agreement. Besides that, the softening seen in the US equity markets at the tail-end of last week following the unexpected decline in new home sales and lower-than-forecast fourth quarter gross domestic product growth (2.8 per cent against a forecast 3.0 per cent) could dampen local market sentiment as well.

The Fed's decision last week to keep interest rates low through at least late 2014 and indication of further quantitative easing if needed underscores the importance given to sustain confidence and liquidity in the system to keep the economy afloat amid rising threat from the unraveling European debt crisis. While many countries in this region have pursed monetary easing in recent months to sustain economic growth momentum, Bank Negara Malaysia is expected to maintain the Overnight Policy Rate at 3.0 per cent when the policymakers meet tomorrow. It is not without an option to cut rates if needed in the future as inflation remained tame at 3.0 per cent last month and is expected to hover around 2.5 per cent this year. However, it may maintain rates to gauge the impact of abundant liquidity globally on commodity prices, especially those related to energy and food.

The abundant liquidity in the US, liquidity injections in Europe and the possibility of China following suit with monetary easing measures soon after the stringent tightening last year affected its property market and showed tendency of dragging the economy lower this year, indicate the possibility of inflationary pressures overshooting expectations. The European Union's ban on oil imports from Iran starting July 1 will not only exert upside pressure on crude oil prices but also on products and services along the supply chain although major oil producing nations like Saudi Arabia have committed to fill the gap. The imbalance in demand and supply will be amplified if Iran retaliates by closing the Strait of Hormuz or the standoff leads to military strikes.

Whatever the case, with huge investments going into the oil and gas sector, domestically and globally, local players could see a strong revival in upstream and downstream activities this year. As many listed lower liners are still trading at a single-digit price-to-earnings ratio and a huge discount to their potential target price and bigger listed counter parts, a second look at this undervalued cyclical sector could be fruitful for investors although the current investment mantra is to remain defensive.

Technical outlook

In index futures, spot month January traded on Bursa Malaysia Derivatives lost two points week-on-week to 1,523, shrinking marginally to a 2.1-point premium to the cash index compared with the 2.34-point premium in the previous week.

Share prices on Bursa Malaysia closed lower on Wednesday, as concerns over eurozone debt woes dampened sentiment on the first trading day in the Year of the Water Dragon. The FBM KLCI ended down 2.9 points at 1,519.76, off a high of 1,527.57 and low of 1,518.35, as gainers edged losers 389 to 315 in moderate trade totaLling 1.34 billion shares worth RM1.54 billion.

The market rose in line with most other markets in the region the following day, as stocks took the cue from overnight gains on Wall Street after the US Federal Reserve's pledge to keep interest rates low for at least two years more. However, gains were limited due to lingering concerns over the Greek debt situation. The FBM KLCI gained 4.1 points to close at 1,523.86, off an early low of 1,519.86, as gainers edged losers 524 to 233 in trade totalling 1.95 billion shares worth RM1.69 billion.

While blue chips staged a consolidation on Friday, rotational buying interest picked up in lower liners such as DRB-HICOM, Maybulk and Mudajaya with their call warrants enjoying huge percentage gains due to increased retail participation. At the close, the FBM KLCI dipped 2.96 points to 1,520.9 as gainers led losers 459 to 370 on total volume of 2.28 billion shares worth RM1.85 billion.

The trading range for the FBM KLCI shrank to 9.22 points last week, compared with the 13.92-point range in the previous week, as blue chips extended their consolidation.

Among the other indices, the FBM-EMAS Index edged up 51.45 points, or 0.5 per cent, to 10,578.33, while the FBM-Small Cap Index surged 343.55 points, or 2.8 per cent, to 12,536.36, as small-cap stocks attracted strong speculative interest from momentum players.

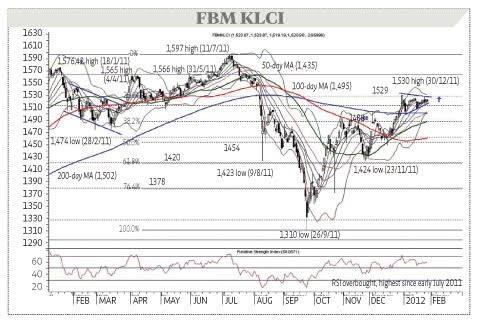

The daily slow stochastics for the FBM KLCI is hovering in the positive momentum zone but flashed an initial hook-down signal, while the weekly indicator continued levelling in the overbought region. The 14-day Relative Strength Index (RSI) hooked down for a reading of 58.06, while the 14-week RSI levelled off to read 56.23.

As for trend indicators, the daily Moving Average Convergence Divergence (MACD) continued levelling off to signal short-term consolidation, but the weekly MACD is getting more bullish with a positive expansion against the signal line. The +DI and -DI lines on the 14-day Directional Movement Index (DMI) trend indicator also continued to expand positively, but the ADX line is leveling off to signal consolidation.

Conclusion

While trend indicators for the FBM KLCI start to weaken, trading momentum seems to be improving with positive market breadth and increasing trading interest in lower liners and small-cap stocks bullish for the broader market. As such, while the blue-chip index is likely to congest this week, trading interest should start switching to lower liners, ACE Market and small-cap stocks with positive news flow likely to pick up pace as more investors return from a long Chinese New Year holiday break.

In blue chips, banking stocks AMMB and CIMB should rise after their extended base building, while for lower liners, stocks in rubber glove, property, construction and sectors such as Supermax, Hua Yang, Mah Sing, UEM Land, DRB-HICOM and Muhibbah Engineering should outperform the broader market in coming weeks.

For the FBM KLCI, a potential triangle breakout pattern has formed, with breakout confirmation above the December 30 2011 peak of 1,530 to boost upside momentum towards next upside target at last April/May highs at 1,565/1,566, with higher target from the January 18 peak of 1,576 last year, and ultimately the all-time high of 1,597. Immediate downside cushion is at the middle Bollinger band, currently at 1,518, next would be 1,501, the levelling 200-day moving average support.

Stronger retracement supports are at 1,488, the 61.8 per cent Fibonacci Retracement of the 1,597 to 1,310 sell-off, followed by 1,488, the current 50-day moving average, and then the 100-day moving average which is now at 1,461.

The subject expressed above is based purely on technical analyses and opinions of the writer. It is not a solicitation to buy or sell.

No comments:

Post a Comment